Provincial and Territorial Energy Profiles – Ontario

Update in progress

An update to these profiles will launch in Spring 2024. For current data and information, please visit:

- Canada's Energy Future data appendices tool

- Environment and Climate Change Canada's GHG Emissions Inventory

Connect/Contact Us

Please send comments, questions, or suggestions to

energy-energie@cer-rec.gc.ca

Table of Contents

-

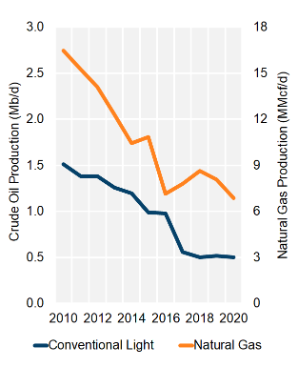

Figure 1: Hydrocarbon Production

Source and Description:

Source:

CER – Canada's Energy Future 2021 Data AppendicesDescription:

This graph shows hydrocarbon production in Ontario from 2010 to 2020. Over this period, crude oil production has decreased from 1.5 Mb/d to 0.5 Mb/d. Natural gas production has deceased from 16.5 MMcf/d to 6.9 MMcf/d. -

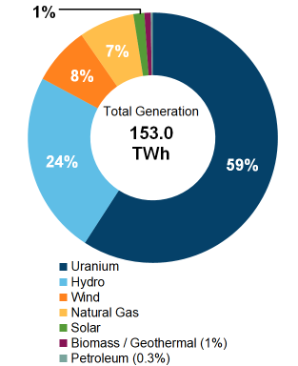

Figure 2: Electricity Generation by Fuel Type (2019)

Source and Description:

Source:

CER – Canada's Energy Future 2021 Data AppendicesDescription:

This pie chart shows electricity generation by source in Ontario. A total of 153.0 TW.h of electricity was generated in 2019. -

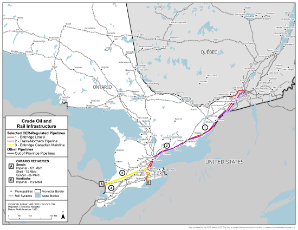

Figure 3: Crude Oil Infrastructure Map

Source and Description:

Source:

CERDescription:

This map shows all major crude oil pipelines, rail lines, and refineries in Ontario.Download:

PDF version [1 307 KB] -

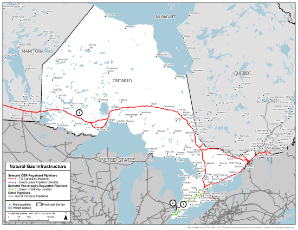

Figure 4: Natural Gas Infrastructure Map

Source and Description:

Source:

CERDescription:

This map shows all major natural gas pipelines in Ontario.Download:

PDF version [1 564 KB] -

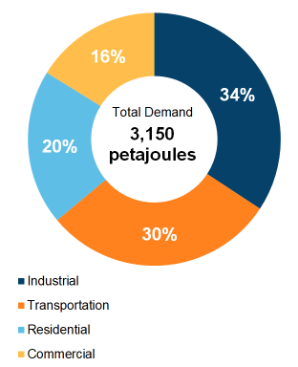

Figure 5: End-Use Demand by Sector (2019)

Source and Description:

Source:

CER – Canada's Energy Future 2021 Data AppendicesDescription:

This pie chart shows end-use energy demand in Ontario by sector. Total end-use energy demand was 3 150 PJ in 2018. The largest sector was industrial at 34% of total demand, followed by transportation (at 30%), residential (at 20%), and lastly, commercial (at 16%). -

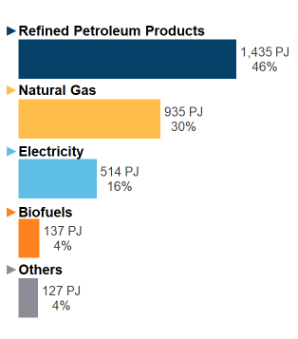

Figure 6: End-Use Demand by Fuel (2019)

Source and Description:

Source:

CER – Canada's Energy Future 2021 Data AppendicesDescription:

This figure shows end-use demand by fuel type in Ontario in 2018. Refined petroleum products accounted for 1 435 PJ (46%) of demand, followed by natural gas at 935 PJ (30%), electricity at 514 PJ (16%), biofuels at 137 PJ (4%), and other at 127 PJ (4%).

Note: "Other" includes coal, coke, and coke oven gas. -

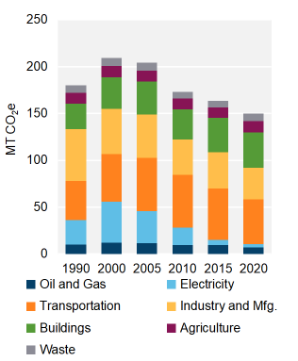

Figure 7: GHG Emissions by Sector

Source and Description:

Source:

Environment and Climate Change Canada – National Inventory ReportDescription:

This stacked column graph shows GHG emissions in Ontario by sector every five years from 1990 to 2020 in MT of CO2e. Total GHG emissions have decreased in Ontario from 180 MT of CO2e in 1990 to 150 MT of CO2e in 2020. -

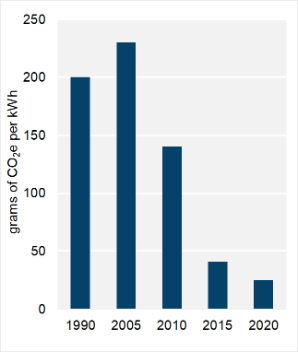

Figure 8: Emissions Intensity from Electricity Generation

Source and Description:

Source:

Environment and Climate Change Canada – National Inventory ReportDescription:

This column graph shows the emissions intensity of electricity generation in Ontario from 1990 to 2020. In 1990, electricity generated in Ontario emitted 200 g of CO2e per kWh. By 2020, emissions intensity decreased to 25 g of CO2e per kWh.

Energy Production

Crude Oil

- Ontario produced 500 barrels per day of light oil in 2020 (Figure 1). Ontario’s production represents less than 0.1% of total Canadian oil production (including condensate and pentanes plus).

- All of Ontario’s oil production occurs in southwestern Ontario. Oil and gas resources in the province are currently extracted using conventional methods.

- Ontario is home to Canada’s first commercial oil production. Oil was first discovered in Canada near Black Creek (later renamed Oil Springs) in 1858. Other oil deposits were discovered in the 1860s in Petrolia, just north of Oil Springs.

- Ontario’s remaining resource of crude oil is estimated to be 11.0 million barrels as of the end of 2019.

Refined Petroleum Products (RPPs)

- Ontario has four refineries: Imperial Oil, Suncor, and Shell in or around Sarnia, and Imperial Oil in Nanticoke. These refineries have a total capacity of 393 thousand barrels per day (Mb/d), which gives Ontario the second largest refining capacity, after Alberta, and accounts for 20% of total Canadian refining capacity.

- Western Canada supplies most of the crude oil for Ontario’s refineries. Imports from the United States (U.S.) account for around 10% of total crude oil consumed by Ontario’s refineries.

Natural Gas/Natural Gas Liquids (NGLs)

- In 2020, natural gas production in Ontario averaged 6.9 million cubic feet per day (MMcf/d) (Figure 1). Ontario’s production represented less than 0.1% of total Canadian natural gas production in 2020. All of the province’s natural gas production is in southern Ontario.

- Ontario’s remaining resource of recoverable, sales-quality natural gas was estimated to be 665 billion cubic feet (Bcf) at year-end 2019.

- The Sarnia NGL fractionator is one of the main sources of propane and butane for eastern Canada. It processes NGL mix delivered from western Canada by the Enbridge Mainline (Lines 1 and 5). From Sarnia, propane is delivered by rail and truck to locations in Ontario, Quebec, other eastern Canadian provinces, and to export markets in the U.S. Midwest and East Coast.

- There is no field production of NGLs in Ontario.

Electricity

- In 2019, Ontario generated 153.0 terawatt-hours (TWh) of electricity (Figure 2), which is 24% of total Canadian generation. Ontario is the second largest producer of electricity in Canada and has an estimated generating capacity of 40 200 megawatts (MW).

- In 2019, about 92% of electricity in Ontario was produced from zero-carbon sources: 59% from nuclear, 24% from hydroelectricity, 8% from wind, and 1% from solar. The remainder is primarily from natural gas and some biomass. Ontario’s electricity generating capacity is mainly located in southern parts of the province, but large hydro generating stations located in eastern Ontario in the Ottawa River Basin and northeastern Ontario in the Moose River Basin.

- Three nuclear power plants with a combined 12 633 MW of installed capacity provide the bulk of Ontario’s baseload generation. Bruce Power on the east shore of Lake Huron is the largest, with eight generation units and a capacity of about 6 600 MW. It is one of the largest nuclear power plants currently operating in the world.

- In 2015, the Ontario government approved refurbishing 10 nuclear generation units–six at the Bruce Power site and four at the Darlington site. This $26 billion 15-year program is one of the largest non-emitting energy projects in North America. The first unit at Darlington, Unit 2, started its refurbishment outage in October 2016 and returned to commercial operation in June 2020. The first Bruce unit to undergo refurbishment is Unit 6, which started its outage in January 2020.

- Ontario has over 200 hydroelectricity generation facilities with a total capacity of 9 160 MW.

- Ontario leads Canada in wind capacity. About 5 060 MW of wind capacity was added between 2005 and 2019.

- Ontario had about 97% of Canada’s solar capacity in 2019, with 2 670 MW installed.

- Ontario has the largest 100% biomass-fueled plant in North America. The 205 MW Atikokan Generating Station was converted from coal in 2014.

- Ontario and Alberta are the only jurisdictions that have competitive generation and retail markets for electricity.

- Ontario Power Generation (OPG) is the largest utility in Ontario’s competitive electricity market, with over 18 600 MW of capacity.

Energy Transportation and Trade

Crude Oil and Liquids

- Sarnia is the major oil refining and petrochemical hub in Ontario. Sarnia receives crude oil and NGLs from western Canada and North Dakota via Enbridge’s Lines 5 and 78, which form part of the Enbridge Mainline and have capacities of 540 Mb/d and 500 Mb/d, respectively (Figure 3).

- Enbridge’s Lines 9 and 7 run eastwards from Sarnia to supply refineries in eastern Ontario and Quebec. Line 9, which is not part of the Enbridge Mainline System, has a capacity of 300 Mb/d and transports crude oil to Westover, Ontario, and Montreal, Quebec. Line 7 has a capacity of 180 Mb/d and also delivers crude oil to Westover. At Westover, both pipelines interconnect with Enbridge’s Line 10 and Line 11.

- Line 11 has a capacity of 117 Mb/d and supplies Imperial Oil’s Nanticoke refinery.

- Line 10 has a capacity of 74 Mb/d and delivers crude oil to the United Refining Company’s refinery in Warren, Pennsylvania, via United’s Kiantone Pipeline in New York. United’s subsidiary, Westover Express, acquired Line 10 from Enbridge, but Enbridge will continue to operate the pipeline until 2023.

- The Trans-Northern Pipeline delivers refined petroleum products, such as gasoline and diesel, from refineries in Montreal, Quebec, to major markets and distribution centres in Ontario, including delivery points in Ottawa, Kingston, Belleville, Oshawa, Toronto, and Oakville. The pipeline operates bi-directionally between Toronto and Oakville. The Trans-Northern Pipeline also transports RPPs from Imperial Oil’s Nanticoke refinery eastward to Toronto. Total receipts on the pipeline were 124 Mb/d in 2020. Receipts on the pipeline have generally been declining over the past decade.

- There are two ethane-importing pipelines in Ontario. Energy Transfer’s 50 Mb/d Mariner West Pipeline ships ethane from the Marcellus producing region in Southwestern Pennsylvania to the Canada/U.S border, and continues on the Genesis Pipeline to NOVA Chemical’s petrochemical complex in Corunna, Ontario. The 50 Mb/d Utopia Pipeline ships ethane from Harrison County, Ohio, to Windsor, Ontario.

- Imperial Oil’s Nanticoke refinery has a rail terminal with an estimated crude oil offloading capacity of 20 Mb/d.

Natural Gas

- TC Energy’s (formerly TransCanada) Canadian Mainline begins at the Alberta/Saskatchewan border and transports western Canadian gas through the Prairies to Ontario, and through a portion of Quebec (Figure 4).

- The Mainline connects with other pipelines at several import/export points in southern Ontario. It also connects to the Trans-Quebec and Maritimes (TQM) pipeline at the Ontario/Quebec border.

- Historically, Ontario was largely supplied by western Canadian natural gas and more natural gas was exported to the U.S. than imported. In recent years, Ontario has become a net importer by increasing gas imports from the U.S. Northeast and Midcontinent.

- The Dawn Hub, one of North America’s major natural gas trading hubs and pricing benchmarks, is located in southwestern Ontario. With a capacity of about 281 Bcf, Dawn is home to more than 30 underground storage pools accounting for about 30% of Canada’s underground natural gas storage capacity.

- On 1 January 2019, Ontario’s two main distribution companies, Union Gas and Enbridge Gas Distribution Inc., merged into one company, Enbridge Gas Inc. (EGI). EGI delivers natural gas to 3.8 million customers in over 355 municipalities and 21 indigenous communities in Ontario through over 147 600 kilometres (km) of pipeline. EGI is regulated by the Ontario Energy Board.

Liquefied Natural Gas (LNG)

- Union Gas operates the small-scale Hagar LNG liquefaction and storage facility near Sudbury. It has been in operation since 1968 and has 0.6 Bcf of LNG onsite storage.

Electricity

- Ontario’s net interprovincial and international electricity outflows were 12.8 TWh in 2019.

- Hydro One owns and operates almost all of Ontario’s transmission capacity and has about 30 000 km of transmission lines.

- Hydro One is also the largest distributor of electricity in the province, serving nearly 1.4 million predominantly rural customers that represent approximately 26% of the total customers in Ontario. There are over 60 distribution companies operating in Ontario.

- The Independent Electricity System Operator (IESO) manages the province’s power system by balancing supply with demand and directing power across high-voltage transmission lines.

- Ontario has interconnections with Manitoba, Quebec, Michigan, Minnesota, and New York. Most of Ontario’s imports come from Quebec while most of Ontario’s exports go to New York and Michigan.

- The Ontario Energy Board regulates the energy sector in Ontario, including electricity.

Energy Consumption and Greenhouse Gas (GHG) Emissions

Total Energy Consumption

- End-use demand in Ontario was 3 150 petajoules (PJ) in 2019. The largest sector for energy demand was industrial at 35% of total demand, followed by transportation at 30%, residential at 19%, and commercial at 16% (Figure 5). Ontario’s total energy demand was the second largest in Canada, and the ninth largest on a per capita basis.

- Refined petroleum products were the largest fuel type consumed in Ontario, accounting for 1 451 PJ, or 46% of total end-use demand. Natural gas and electricity accounted for 941 PJ (30%) and 501 PJ (16%), respectively (Figure 6).

Refined Petroleum Products (RPPs)

- Ontario’s motor gasoline demand in 2019 was 1 192 litres per capita, 6% below the national average of 1 268 litres per capita.

- Ontario’s diesel demand in 2019 was 513 litres per capita, 40% below the national average of 855 litres per capita.

- Refineries in the province can produce roughly 75% of Ontario’s demand for RPPs, including gasoline. Imports are mainly from Quebec, delivered via the Trans-Northern Pipeline, rail, and truck. Imports also come from the U.S. Midwest.

Natural Gas

- Ontario consumed an average of 2.7 Bcf/d of natural gas in 2020. Ontario demand represented 24% of total Canadian demand, making it the largest consuming province after Alberta.

- Ontario’s largest consuming sector for natural gas was the industrial sector, which consumed 1.1 Bcf/d in 2020. The residential and commercial sectors each consumed 0.8 Bcf/d.

Electricity

- In 2019, annual electricity consumption per capita in Ontario was 9.6 megawatt-hours (MWh). Ontario ranked eleventh in Canada for per capita electricity consumption and consumed 36% less than the national average.

- Ontario’s largest consuming sector for electricity in 2019 was commercial at 53.3 TWh. The residential and industrial sectors consumed 43.9 TWh and 41.6 TWh, respectively.

GHG Emissions

- Ontario’s GHG emissions in 2020 were 149.6 megatonnes (MT) of carbon dioxide equivalent (CO2e). Ontario’s emissions have declined 17% since 1990 and 27% since 2005.Footnote 1

- Ontario’s emissions per capita are the third lowest in Canada, at 10.1 tonnes of CO2e – 43% below the Canadian average of 17.7 tonnes per capita.

- The largest emitting sectors in Ontario are transportation at 32% of emissions, buildings (residential and commercial) at 25%, and industries and manufacturing (including iron, steel, and chemicals) at 23% (Figure 7).

- Ontario’s GHG emissions from the oil and gas sector in 2020 were 7.2 MT CO2e. Of this total, 1.5 MT were attributable to production, processing, and transmission and 5.7 MT were attributable to petroleum refining and natural gas distribution.

- In 2020, Ontario’s electricity sector emitted 3.2 MT CO2e emissions, or 6% of total Canadian GHG emissions attributable to power generation. Ontario’s GHG emissions from power generation peaked in 2000 at 43.4 MT CO2e and then declined as the province phased out coal-fired generation from 2005 to 2014.

- The greenhouse gas intensity of Ontario’s electricity grid, measured as the GHGs emitted in the generation of the province’s electric power, was 25 grams of CO2e per kilowatt-hour (g of CO2e/kWh) electricity generated in 2020. This is an 89% reduction from the province’s 2005 level of 230 g of CO2e/kWh. The national average in 2020 was 110 g of CO2e/kWh (Figure 8).

More Information

- Ontario Energy Board

- Ontario Ministry of Energy

- CER–Canada's Renewable Power: Ontario

- CER–Market Snapshot: Of nearly 50 companies that export electricity, three account for more than half of all exports in 2019

- CER–Market Snapshot: Ontario’s electricity demand continues to decrease as market demands and efficiencies evolve

- CER–Market Snapshot: Wind surpasses gas-fired power generation in Ontario

- CER–Market Snapshot: Why do electricity rates change throughout the day in Ontario and Nova Scotia?

- CER–Market Snapshot: Ontario and Quebec are among the leaders in North American wind power capacity

- CER–Market Snapshot: Why is Ontario’s electricity demand declining?

- CER–Market Snapshot: U.S. gas continues to displace western Canadian gas in Quebec and Ontario

- CER–Market Snapshot: Ontario consumes less electricity since the beginning of the COVID-19 pandemic

Data Sources

Provincial & Territorial Energy Profiles aligns with the CER’s latest Canada's Energy Future 2021 Data Appendices datasets. Energy Futures uses a variety of data sources, generally starting with Statistics Canada data as the foundation, and making adjustments to ensure consistency across all provinces and territories.

- Date modified: